Limited company business expenses – 6 costs to include

Knowing what business expenses you can claim in your limited company can be tricky. At times, the rules are complex, but you should take the time to get it right. Business expenses help reduce your profit and minimise your tax liability so its crucial you claim the allowances you’re entitled to. Here we explore six business expenses many limited companies forget to include. So, whether you’ve been running your business for years or are just starting out this guide will help to ensure you’re receiving the tax deductions you’re entitled to.

Claiming expenses and minimising your tax

Broadly, a limited company can claim expenses in its accounts and tax return which are “wholly and exclusively for the purposes of the trade.” The more expenses you have in your accounts, the lower your profit and corporation tax bill. So, if you forget to include a business expense in your accounts then you will be paying too much tax. Sometimes this happens when a Director pays for a business item personally and is not reimbursed.

It’s not just paying for items personally though, as there are allowances you may be entitled to which you are not claiming. If these are not claimed, then profits will be higher, and you will pay more tax than you have to.

There are six expenses which many small business owners do not realise they can claim. So, let’s look at each of these.

Six limited company business expenses many forget to claim

Use of home as office

If you run your Limited company from your home, then you can claim an expense up to £216 per year. This assumes you work from home for between 12 and 23 hours a week. If you work from home more than this your expense could be even higher. The great thing about this, is that use of home is not a taxable benefit on you personally – so you receive £216 tax free and your company reduces its tax bill. A win-win.

You don’t need detailed records to claim this expense, but, if asked, you do need to be able to demonstrate to HMRC that you regularly work from home.

Business mileage

If you use your own vehicle for business travel, then you can reclaim business mileage from your Limited company. This includes travel to client sites, meetings, training, events etc. Note it does not include travel from your home to a fixed place of work, e.g. your office.

Claiming the simplified expense for business mileage reimburses you for all your vehicle running costs (insurance, fuel, repairs) and is not subject to tax. For the company, it increases business expenses and reduces your profit and corporation tax bill.

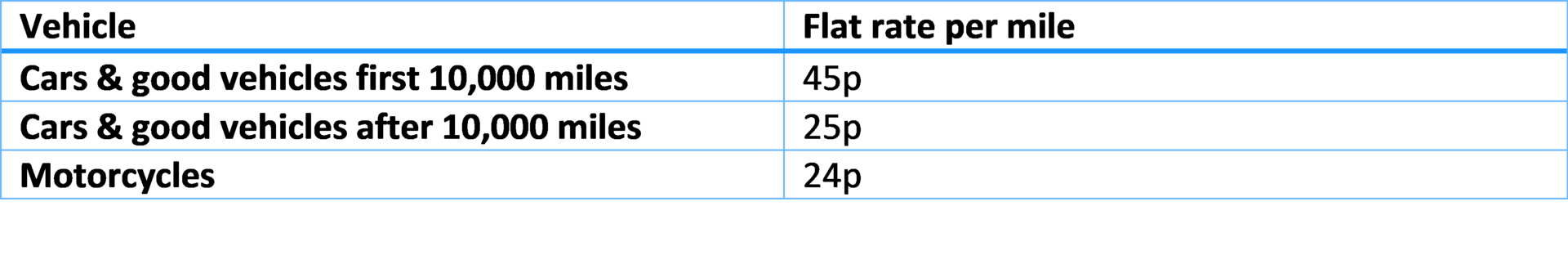

The rates you claim business mileage at are shown below:

It’s important to keep a record of your business mileage. We recommend either using a spreadsheet to do this or one of several mobile apps, which have direct integration with many accounting packages. At a low monthly cost, tripcatcher is worth a look.

Travel and subsistence

It’s not just business mileage which you can claim. Any other travel costs to a temporary place of work should also be claimed by you. So, make sure you reclaim any train costs, airline fares, taxis, congestion charges & tolls etc. which you’ve paid for personally. As above, you cannot claim for travel which is part of your everyday commute to a fixed place of work e.g. your office.

You may also be able to claim for subsistence costs, such as food and overnight expenses when travelling for work. So long as you are required to travel from your normal place of work and the meal is reasonable and not incurred too close to home then you should be able to claim for it. This will help to ensure you’re not out of pocket due to business expenses. The company can treat this as a deductible expense, unless it includes any client entertaining.

Christmas party & staff events

Each year, you and your employees can enjoy an annual event of up to £150 per head tax free. This does require you to meet a few conditions. Generally, your annual event must be to entertain staff, but it should be okay if they bring their Partners too. This is a great way to reward workers for their hard work during the year and should not be a taxable benefit. It is also a deductible expense for the company helping to reduce your corporation tax bill.

As an example, a company with 4 staff members and their Partners could spend up to £1,200 (8 x £150) tax-free each year. Note the £1,200 should include any VAT.

Pension contributions

As the Director of your own limited company, one way to remunerate yourself tax efficiently is for the company to contribute towards your personal pension. Each year you can make a contribution of up to £40,000 into your personal pension. The main benefit of doing this direct from your company is that it is treated as an expense for the company, which should be deductible for corporation tax purposes. A contribution of £40,000 will help to reduce your corporation tax charge by around £8,000.

Not only that, but you will not be taxed personally on the contribution, so it is a great way to extract money without any immediate tax consequences. It’s important to remember though, that depending on your circumstances this money may be locked away for a number of years and will be subject to tax when it is withdrawn from the pension in the future.

If you are considering this, we recommend getting in touch with us first as there are a few things to consider beforehand.

Charitable donations

Many business owners make charitable donations during the course of a year. If your business is profitable, then you are entitled to tax relief on donations made to a registered charity. This is a deductible expense for the business and helps to reduce your corporation tax bill.

It’s worth considering whether making the contribution personally will result in a greater tax deduction though. For individuals who are subject to higher or additional rate tax you will receive relief at 40% or 45% respectively. The corporation tax rate is circa 20% and so relief in a company will be lower for these individuals. In this instance, you may prefer to pay it personally and maximise your tax relief.

Summary

It’s important to take the time to maximise your limited company business expenses and reduce your corporation tax. This guide has hopefully given you an understanding of six business expenses which many limited companies do not claim for. Make sure you are reimbursed for expenses you incur personally and give a thought to how you can keep your tax bill low by claiming allowances you’re entitled to.

If you’d like to discuss any of the items here then please do get in touch. You can check out our other blog posts here too.