Company car tax – incentives for electric & hybrid vehicles

Following a recent government announcement , new petrol and diesel cars will no longer be sold from 2035. This is part of the government plan to achieve an overall net-zero emissions target in the UK.

With such an ambitious target set, the Government have provided a series of incentives to individuals and businesses to purchase wholly electric vehicles. From a business point of view, we believe it is important that you are aware of these potentially beneficial changes.

Opportunity

From 6 April 2020 the following incentives will be available to businesses and individuals. The key points to note are:

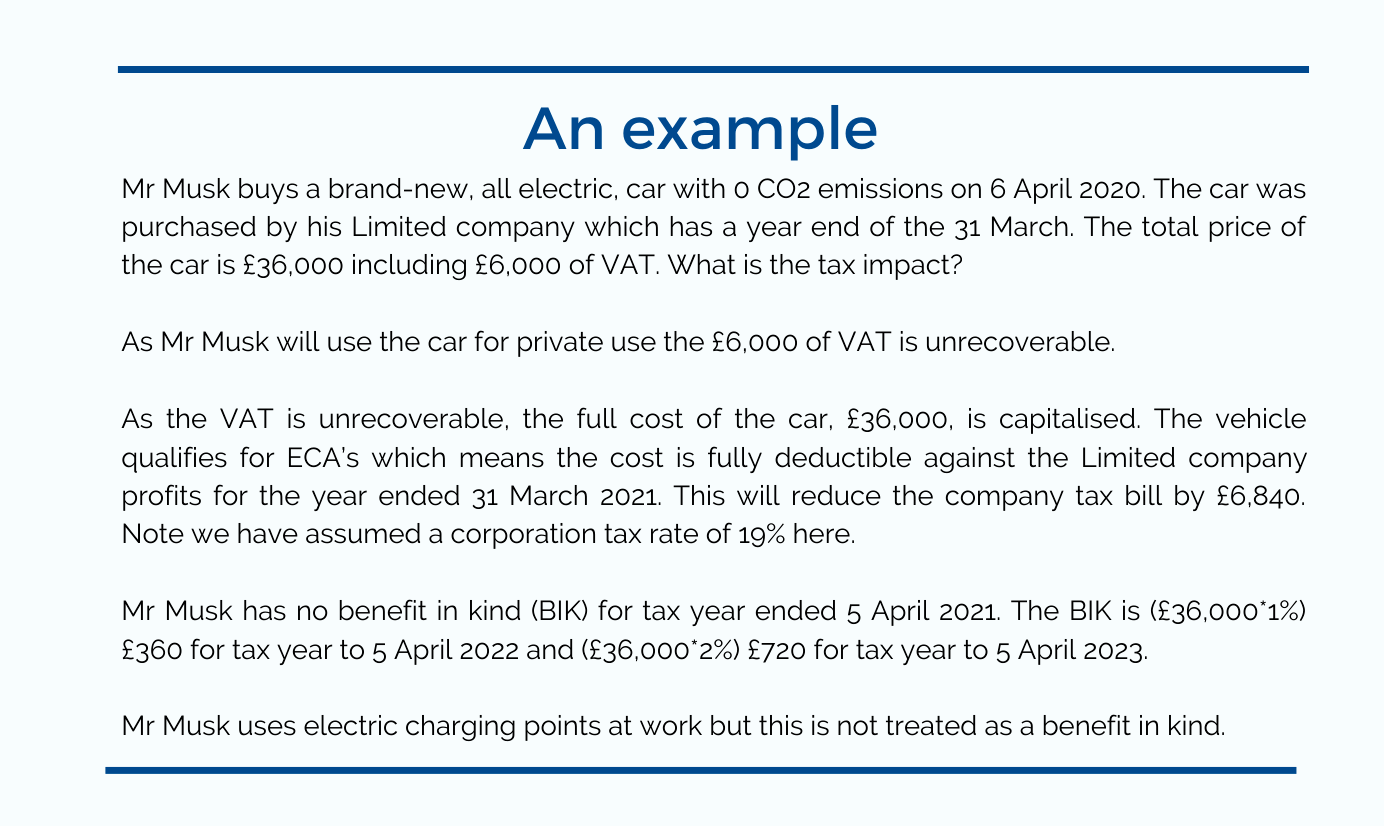

- A new, unused, electric or hybrid car with CO2 emissions below 50 g/km, purchased through a company, will be entitled to 100% Enhanced Capital Allowances (‘ECA’) in the year of purchase. The full cost is tax deductible in year 1 against company profits. Please note that any future proceeds on disposal will be taxable.

- For 2020/2021 the benefit in kind for wholly electric vehicles will be 0%. It rises to 1% for 2021/2022 and 2% for 2022/2023. By comparison, the current rate for 2019/2020 is 16%.

- The cost to an employer of installing electric charging points at work will also qualify for 100% ECA until 5 April 2023. This means the full cost is tax deductible in the year of installation.

- Government grants are available to reduce the purchase price of new wholly electric vehicles (up to £3,500 for cars and £8,000 for vans). There are also grants for the cost of installing the electric charging points (up to £500).

- Employees can buy or lease a car under the payroll salary sacrifice rules.

- Workplace charging exemption; the provision of electric charging points at work will not be regarded as a benefit to employees.

- Advisory fuel rate of 4p will be given on all business trips.

Further information on Company car tax

Used Electric Vehicles

The 100% ECAs allowance provided for new electric cars is not available, however, capital allowances can be claimed on an annual basis at 18%.

Leased Electric Vehicles

Leasing a car through the company could be done through a tax efficient salary sacrifice arrangement if ownership is corporate. If the company pays the lease for a director’s private car then only the business use can be deducted as a corporate expense.

VAT matters

If your company purchases the vehicle outright and it is available for private use none of the VAT is recoverable. Where it is not available for private use, you can however claim the VAT back (subject to restrictions). Alternatively, if your business leases the vehicle then regardless of private use 50% of the VAT on the rentals is recoverable.

Want to find out more?

Please note that the rules and allowances are changing rapidly on this new technology. So, if you are considering buying a new electric car or would like to discuss this further please get in touch.